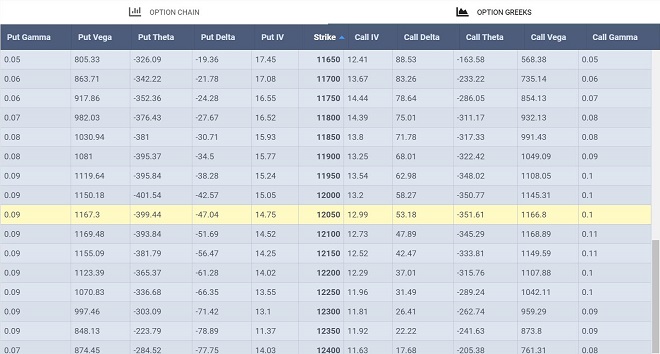

Navigating the NSE Option Chain: Understanding Options Greeks and Their Impact

The NSE Option Chain is a dynamic and complex tool that provides a wealth of information for traders seeking to understand and analyze option contracts. Options Greeks, a set of mathematical measures, play a crucial role in deciphering the behavior of options and their sensitivity to various market factors. By understanding and applying Options Greeks, traders can make informed decisions, navigate the complexities of the NSE Option Chain with greater confidence, and potentially enhance their trading success. Check what is demat?

Unveiling the Options Greeks

The five primary Options for Greeks are:

Delta (Δ): Delta measures the rate of change in an option’s price relative to a small change in the underlying asset’s price. It indicates the direction and magnitude of the option’s price movement in response to a change in the underlying asset’s price.

Theta (Θ): Theta represents the rate of time decay of an option’s value. As the expiration date approaches, theta becomes more negative, reflecting the accelerated decline in the option’s value due to time decay. Check what is demat?

Vega (ν): Vega measures the sensitivity of an option’s price to changes in implied volatility. Higher implied volatility, reflecting increased market expectations of future price fluctuations, leads to higher option premiums, and vice versa.

Gamma (Γ): Gamma indicates the rate of change in an option’s delta. It represents the sensitivity of delta to changes in the underlying asset’s price. Higher gamma implies a more rapid change in delta, suggesting a more pronounced impact of underlying asset price movements on the option’s price. Check what is demat?

Rho (ρ): Rho measures the sensitivity of an option’s price to changes in interest rates. While primarily relevant for long-term options, rho indicates the potential impact of interest rate fluctuations on the option’s value.

Impact of Options Greeks on NSE Option Chain Trading

Options Greeks provide valuable insights into the behavior of options and their sensitivity to various market factors, influencing NSE Option Chain trading in several ways:

Assessing Option Sensitivity: Options Greeks allow traders to understand how an option’s price will react to changes in the underlying asset’s price, volatility, interest rates, and time decay. This information is crucial for evaluating the potential risks and rewards of various option strategies. Check what is demat?

Refining Trading Strategies: Options Greeks aid in developing and refining trading strategies. By understanding the sensitivity of options to different factors, traders can tailor their strategies to align with their risk tolerance, market expectations, and trading goals.

Managing Risk Effectively: Options Greeks play a pivotal role in risk management. Analysing the sensitivity of option prices to various factors allows traders to implement appropriate risk mitigation strategies, such as hedging, to protect their capital.

Making Informed Decisions: By understanding and applying Options Greeks, traders can make informed decisions regarding option selection, position sizing, and strategic execution. This knowledge empowers traders to navigate the complexities of the NSE Option Chain with greater confidence and potentially enhance their trading success.

Conclusion

Options Greeks are indispensable tools for navigating the NSE Option Chain effectively. By understanding and applying these measures, traders can gain a deeper understanding of option pricing dynamics, refine trading strategies, manage risk effectively, and make informed decisions that align with their financial goals and risk tolerance. Check what is demat?